Four Paths to the End of Life – One Far More Expensive than Others

ANN ARBOR, Mich. — Last-ditch, high-tech heroic treatments. Days in the hospital intensive care unit. You might think this is what makes dying in America so expensive – and that it’s where we should focus efforts to spend the nation’s healthcare dollars more wisely.

But a new study finds that for nearly half of older Americans, the pattern of high spending on health care was already in motion a full year before they died.

That’s thanks to the care they received for their multiple chronic health conditions -- including many doctor visits and regular hospital stays over the year, not just in their final days.

As a result, the study shows, the last year of life for this large group of seniors costs the Medicare system five times as much as the care received by the much smaller group of seniors who have a sudden burst of very expensive care in their last few weeks of life. The findings have clear implications for efforts to improve care, and contain the growth of costs, at the end of life.

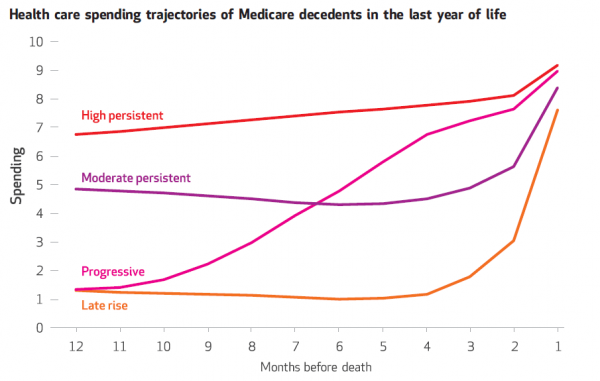

The study shows four clear patterns of end-of-life spending, newly identified through an analysis of Medicare data by team led by University of Michigan researchers. They have published their findings in Health Affairs.

Lead author Matthew A. Davis, Ph.D., M.P.H., an assistant professor at the U-M School of Nursing and member of the U-M Institute for Healthcare Policy and Innovation, says the findings surprised him and his colleagues from the U-M Medical School and School of Public Health, and the Dartmouth Institute for Health Policy and Clinical Practice.

“We were expecting to find the most common pattern to be explosive healthcare spending in the final months of life. In fact, only 12 percent of older adults in our study showed this ‘late rise’ pattern of healthcare spending,” he says.

“Our research points to having to do a better job taking care of people who have multiple chronic conditions in a way that maintains or improves the quality of care they receive, but with cost in mind,” he continues. “This also suggests that if we focus purely on care for those with a poor prognosis, we won’t be able to contain the growth of health costs that you might anticipate.”

The team named the four patterns of end-of-life healthcare spending:

- High Persistent: This group made up nearly half of the Medicare participants studied and had high (and slightly rising) spending throughout the final year of life. In the last year of life, their care cost Medicare around $59,394 (the median value), and they had twice as many outpatient visits to medical specialists as other groups. They also were more likely to spend time in hospitals and skilled nursing facilities, and more likely to get treated using life-prolonging treatments: a respirator, dialysis or a feeding tube.

- Moderate Persistent – This group made up 29 percent of the patients studied. Their final year started with moderately high amounts of spending, then it dipped down for a while, and then went up in the last few months of life. Their care cost about $18,408 in that final year.

- Progressive – This group only accounted for 10 percent of the patients, but had the second-highest costs, with a median of $37,036. These individuals had very low spending at the start of their last year of life, but it rose steadily, in a straight line, throughout the last year of life. This group was also the most likely to use hospice care, perhaps because they and their families and physicians had a good sense that they did not have long to live.

- Late Rise – With just $11,166 in median health care costs in their final year, this group made up only 12 percent of the total group. They had very low health spending up until a few months before they died, far lower numbers of physician visits and hospital stays, and no or few chronic conditions. They were more likely to die during a hospital stay that included time in an ICU and had the second-highest use of life-prolonging treatments.

There were no clear differences in the healthcare spending patterns when the researchers compared people who had specific major diseases such as cancer, cardiovascular disease and organ failure. Instead, the driving force behind the spending pattern that each person followed appeared to be based on the number of different health conditions he or she had.

Davis and his colleagues used 2011-2012 data from the Centers for Medicare and Medicaid Services. The data were from nearly 100,000 randomly sampled traditional Medicare participants who died in 2012. They drew their sample from data on nearly 1.3 million Americans aged 66 to 99 who died during the period studied.

The study did not account for prescription drug and out-of-pocket spending, nor data on seniors enrolled in Medicare Advantage plans managed by private companies. Another recent U-M study found that Medicare Advantage participants tend to be healthier in their last year of life than those in traditional fee-for-service Medicare.

The study period coincided with the early stages of the “population health” movement, which has increased since that time. Medicare, through programs such as Accountable Care Organizations, is incentivizing doctors’ groups and hospitals to improve care and the patient experience while containing cost growth, by offering them extra payment if they achieve goals across a broad swath of patients enrolled in traditional Medicare.

This has led to care management programs and efforts to support patients between doctor visits or when new issues crop up, which may help with the complex patients who had the highest spending rates in the new study.

In addition to Davis, the study’s authors include Julie P.W. Bynum at Dartmouth and U-M’s Brahmajee Nallamothu, M.D., M.P.H., and Mousumi Banerjee, Ph.D., M.S. The study was funded by the National Institute on Aging at the National Institutes of Health (AG019783) and NIH grant AT006162.